To take benefit of out of Lotto smart picks, gamers should undertake varied techniques that improve their number selection.

To take benefit of out of

Lotto Analysis smart picks, gamers should undertake varied techniques that improve their number selection. One of the simplest strategies includes analyzing the earlier successful numbers of the specific lottery you wish to play. By making a comprehensive database of these outcomes, gamers can spot recurring numbers and mixture patterns. Another useful strategy is to employ the concept of number wheeling, a system that permits players to cover a broader vary of mixtures primarily based on their chosen numbers, thus potentially growing their probabilities of winning without having to buy an extreme variety of tickets. Furthermore, using on-line instruments and software designed for lottery analyses can additional help players in making strategic choices, often refining their decisions using sophisticated algorithms primarily based on historic information.

Incorporating tracking

Lotto Number Generator quantity frequency into your lottery technique can be an enticing way to improve your gaming experience. Whether you're a casual participant or a devoted participant, understanding the frequency of drawn numbers provides a new layer of pleasure to the method. Remember to balance statistical analysis with the joys of the sport. Set realistic expectations, stay knowledgeable, and be open to adapting your method as wanted. Ultimately, the aim should be to enjoy the experience, regardless of the end result, and to strategy every draw with a sense of anticipation and pleasure.

When somebody wins the lottery, they might be stunned to discover that their pleasure can rapidly be overshadowed by monetary realities like taxes. In common, lottery winnings are thought-about taxable income by the government. For instance, in the United States, the IRS treats these winnings as strange earnings, which suggests they're subject to federal tax charges that may be as excessive as 37%. This tax price applies whether a winner chooses a lump sum payment or annuity installments, although it’s important to note that the total tax liability can vary based on particular person circumstances, including different earnings sources.

Winning the lottery is a dream for lots of, however it additionally comes with its personal set of challenges, particularly in relation to taxes. Understanding

Lotto Prediction payout taxes is crucial for anyone who finds themselves holding a winning ticket. These taxes can significantly reduce the sum of money a winner really receives, leading many to query how they'll finest manage their newfound wealth while navigating the complexities of tax obligations. This article delves deep into how lottery winnings are taxed, providing insights on different taxation rules across various jurisdictions, and offering recommendation on how winners can successfully handle their payouts to reduce tax burdens.

While tracking

Lotto Auto Number quantity frequency presents gamers a possible edge, it's crucial to acknowledge its limitations. One common false impression is the assumption that frequency tracking can predict future outcomes with certainty. In reality, each draw is an isolated event, and the lottery stays a sport of probability. Players should keep away from falling into the entice of putting undue reliance on previous numbers to information their decisions. Additionally, tracking frequencies can create bias, leading players to favor explicit numbers at the expense of a broader technique. Therefore, whereas sustaining consciousness of quantity frequency, players should continue to diversify their number choices and method their games with a mixture of strategy and luck.

When you win a lottery, you usually have the option to take your winnings as a lump sum (cash payment) or as an annuity (spread out over a number of years). Each choice has distinct tax implications that can substantially alter your general financial scenario. Choosing the cash possibility usually means you'll receive a smaller complete amount upfront, however you've quick entry to your funds, allowing for investments that may potentially provide a excessive return. On the other hand, the annuity choice offers a gradual revenue stream over a sure period and should have more favorable tax remedy in the long term, notably for these in decrease tax brackets. Understanding the differences between cash and annuity payments is crucial for making an knowledgeable decision about what is going to serve you finest financially.

In addition to tax planning, understanding community assets can lead to improved decision-making. Many communities supply workshops and seminars geared toward educating recent lottery winners on sound financial practices and tax obligations, empowering them with knowledge for efficient cash management. Through continued education and skilled support, winners can navigate the complexities that accompany holding immense wealth.

Before diving into specific strategies, it's essential to understand the percentages related to completely different lotteries. The odds of successful the jackpot can range considerably primarily based on the lottery format. For occasion, traditional lotteries, similar to Powerball or Mega Millions, often have odds ranging from 1 in 292 million to 1 in 302 million, relying on the particular drawing. By understanding these numbers, you can gauge the level of threat and potential reward before investing your cash.

When Using To Lower Lashes

Förbi juniormark5980

When Using To Lower Lashes

Förbi juniormark5980 Sisu | New Hollywood Action Movie Full HD in English 2024 | Jorma Tommila Superhit Action Movie 2024

Förbi bskwfny

Sisu | New Hollywood Action Movie Full HD in English 2024 | Jorma Tommila Superhit Action Movie 2024

Förbi bskwfny Unlocking the Secrets of Trusted Online Togel Sites

Förbi sifuromain5879

Unlocking the Secrets of Trusted Online Togel Sites

Förbi sifuromain5879 Beyoncé Shares RARE Glimpse Inside Her and Jay-Z's Summer Vacation | E! News

Förbi bskwfny

Beyoncé Shares RARE Glimpse Inside Her and Jay-Z's Summer Vacation | E! News

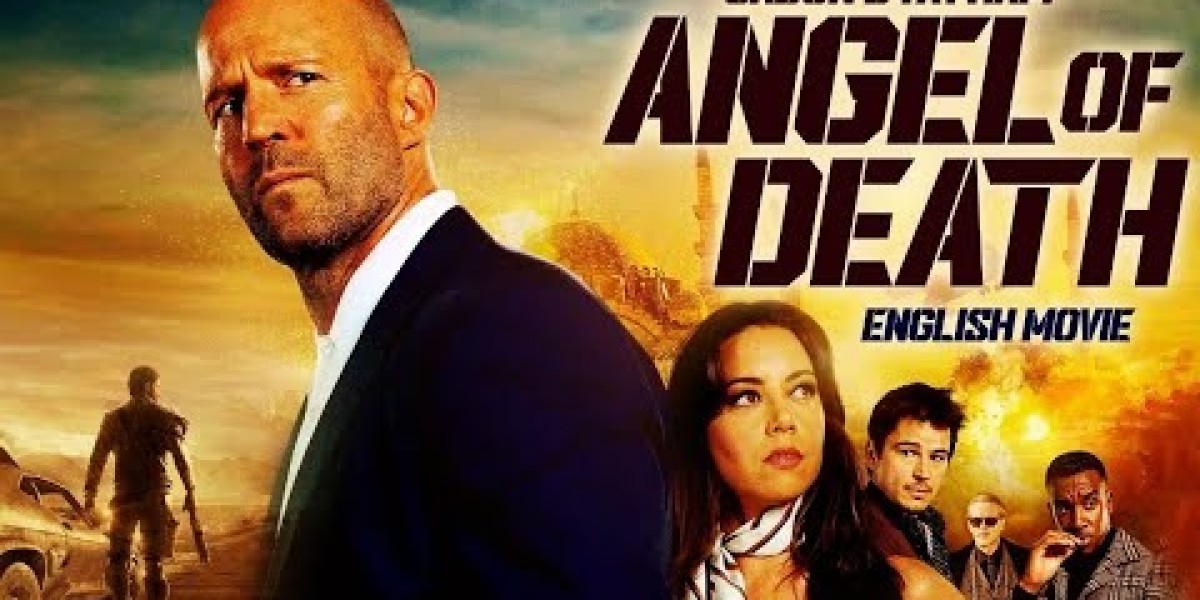

Förbi bskwfny ANGEL OF DEATH - Hollywood Movie | Jason Statham & Agata Buzek | Superhit Crime Action English Movie

Förbi bskwfny

ANGEL OF DEATH - Hollywood Movie | Jason Statham & Agata Buzek | Superhit Crime Action English Movie

Förbi bskwfny