When it comes to setting up a business in India, two of the most popular options are a Limited Liability Partnership (LLP) and a Private Limited Company (Pvt Ltd). Both have their advantages, but they also have distinct differences. Choosing the right structure depends on your business goals, management preferences, and liability concerns. In this article, we will break down the key differences between LLPs and Private Limited Companies in simple terms.

What is an LLP?

A Limited Liability Partnership (LLP) is a business structure that combines elements of a partnership and a limited liability company. In an LLP, two or more individuals or entities come together to form a business with shared responsibility for its management. However, the main advantage of an LLP is that the personal assets of the partners are protected, meaning they are not personally liable for the businesss debts.

Features of an LLP:

Limited Liability: Partners are only liable to the extent of their capital contribution.

No Minimum Capital: Unlike Private Limited Companies, LLPs do not require a minimum capital investment.

Flexibility: LLPs are more flexible when it comes to management and operational decision-making.

Taxation: LLPs are taxed as partnerships, which often leads to simpler taxation rules compared to Pvt Ltd companies.

What is a Private Limited Company?

A Private Limited Company (Pvt Ltd) is a business structure where the liability of its members (shareholders) is limited to their shareholding in the company. Private Limited Companies are the most common form of company structure in India for small and medium-sized enterprises (SMEs). A Pvt Ltd company can have 2 to 200 shareholders, and the company is managed by directors who may or may not be shareholders.

Features of a Private Limited Company:

Limited Liability: Shareholders liability is limited to the amount they have invested in shares.

Separate Legal Entity: A Pvt Ltd company is a separate legal entity from its shareholders. This means the company itself can own property, enter into contracts, and be sued.

Management Structure: Pvt Ltd companies have a formal management structure, including directors and shareholders.

Taxation: Pvt Ltd companies are taxed as corporations, which means they must pay corporate taxes on their profits.

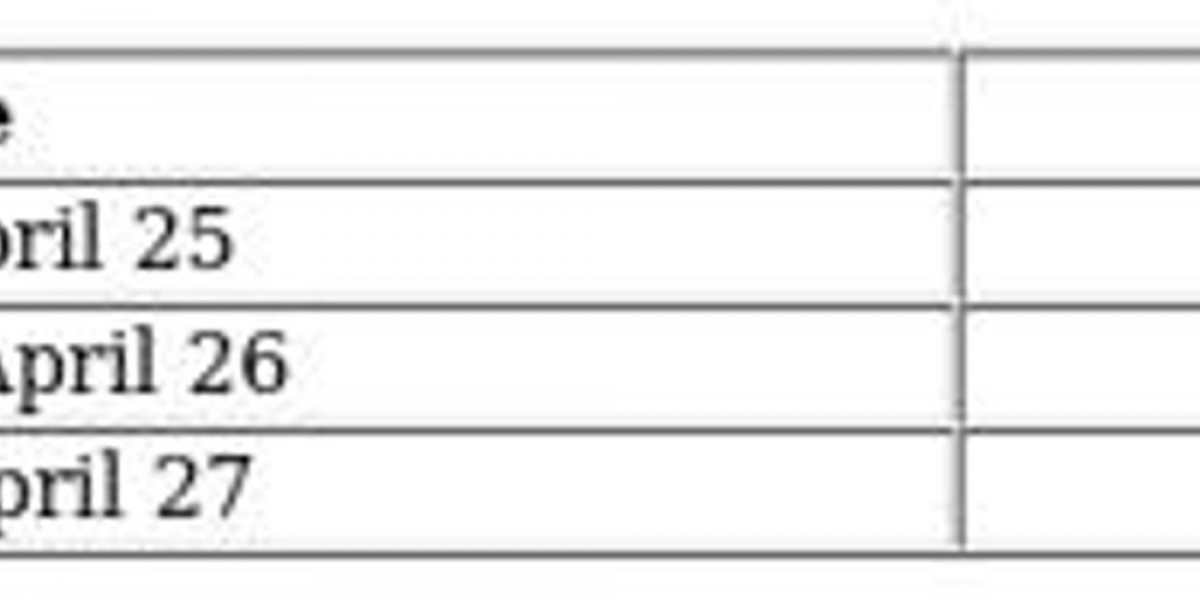

Key Differences Between LLP and Private Limited Company

While both LLPs and Private Limited Companies offer limited liability protection, they differ in several other key areas. Let's explore these differences.

1. Ownership and Management

LLP: Ownership and management in an LLP are typically handled by the partners. Partners have the flexibility to manage the business as they see fit. There is no mandatory requirement for a separate board of directors or shareholders.

Private Limited Company: A Pvt Ltd company has shareholders who own the business, and the company is managed by a board of directors. The shareholders elect directors to run the company. The management is more structured and formal in a Private Limited Company.

2. Number of Members

LLP: An LLP requires at least two partners, and there is no upper limit on the number of partners that can join. Partners can be individuals or other companies.

Private Limited Company: A Pvt Ltd company requires at least two shareholders, but the maximum number of shareholders is limited to 200.

3. Liability

LLP: In an LLP, the liability of partners is limited to their agreed-upon capital contribution. Personal assets of partners are protected from the debts of the business.

Private Limited Company: Shareholders' liability is also limited to the value of their shares in the company. Like an LLP, personal assets are not at risk.

4. Taxation

LLP: LLPs are taxed as partnerships, meaning the profits are taxed at the individual partner level. There is no separate tax for the LLP itself. LLPs also benefit from fewer tax compliances.

Private Limited Company: Private Limited Companies are taxed as separate legal entities. They must pay corporate taxes on their profits, and shareholders also pay taxes on dividends they receive. The overall tax burden can sometimes be higher than that for an LLP.

5. Compliance and Regulation

LLP: LLPs have fewer compliance requirements compared to Private Limited Companies. For instance, LLPs are not required to hold annual general meetings (AGMs) or maintain a formal board of directors.

Private Limited Company: Pvt Ltd companies must comply with more stringent regulatory requirements, such as holding annual general meetings, filing annual financial statements, and maintaining records of board meetings. The paperwork and compliance burden are heavier for Pvt Ltd companies.

6. Capital and Funding

LLP: Raising capital in an LLP can be more challenging. Since it is a partnership-based structure, LLPs cannot issue shares to raise funds. They generally rely on personal investments by partners or loans.

Private Limited Company: Private Limited Companies have more options for raising capital. They can issue shares to raise money from investors. Additionally, Pvt Ltd companies are often more attractive to venture capitalists and investors because of their formal structure.

7. Transferability of Ownership

LLP: In an LLP, transferring ownership is more complicated as it requires the consent of the other partners. The partnership structure is more personal and less fluid when it comes to ownership changes.

Private Limited Company: The ownership of a Pvt Ltd company is easier to transfer. Shares can be bought or sold, and ownership changes do not affect the companys operations. This makes it easier to bring in new investors or transfer control.

8. Perception and Credibility

LLP: While an LLP offers several advantages in terms of flexibility, it may not be seen as credible by banks, investors, or larger clients, as it is a less formal structure.

Private Limited Company: A Pvt Ltd company is usually viewed as more credible due to its formal structure, which can make it easier to establish trust with customers, suppliers, and financial institutions.

9. Exit Strategy

LLP: Exiting from an LLP can be difficult, especially if the business is reliant on the skills or knowledge of specific partners. However, the process of dissolution is relatively simple if the partners agree.

Private Limited Company: Exiting from a Pvt Ltd company is easier. Shares can be sold, or the company can be merged or acquired. This makes it easier for owners to exit if they choose to do so.

Conclusion

Both LLP and Private Limited Companies offer limited liability protection, but the choice between the two depends on various factors such as management structure, taxation, funding needs, and compliance requirements.

If you are looking for a more flexible, less formal structure with simpler compliance, an LLP might be the right choice.

If you plan to raise significant capital, attract investors, or want a more structured and formal business, a Private Limited Company might be a better option.

Consider your business goals, the nature of your industry, and your long-term plans before making the decision. Either way, its a good idea to consult with a legal or financial advisor to ensure you make the best choice for your business.

FAQ

1: Which is better for startups LLP or Private Limited Company?

A Private Limited Company is usually better for startups that plan to raise funding from investors, banks, or venture capitalists. It offers better credibility and easier access to finance. LLPs are more suitable for small businesses and professionals who want less compliance.

2: Can an LLP be converted into a Private Limited Company?

Yes, an LLP can be converted into a Private Limited Company by following the procedures laid out under the Companies Act. Youll need approval from all partners, a name reservation, and to file certain forms with the Ministry of Corporate Affairs.

3: Is audit mandatory for both LLP and Private Limited Company?

Audit is mandatory for Private Limited Companies every year. For LLPs, an audit is required only if the annual turnover exceeds ₹40 lakhs or the capital contribution exceeds ₹25 lakhs.

4: Can LLPs raise funds from investors?

No, LLPs cannot issue shares, so they cannot raise equity capital like a Private Limited Company. They can raise funds only through loans or partner contributions, which limits growth potential.

5: Which has fewer compliance requirements LLP or Private Limited Company?

An LLP has fewer compliance requirements compared to a Private Limited Company. It does not need to hold board meetings or maintain statutory registers, making it easier and cheaper to run for small businesses.